Warner company’s year end unadjusted – Warner Company’s year-end unadjusted trial balance provides a crucial snapshot of the company’s financial position before adjusting entries are made. This comprehensive guide delves into the purpose, components, and significance of this essential accounting document, offering valuable insights for financial professionals and business owners alike.

Understanding the year-end unadjusted trial balance is fundamental for accurate financial reporting and informed decision-making. This document serves as a foundation for adjusting entries and the preparation of financial statements, making it an indispensable tool for ensuring the integrity and accuracy of financial data.

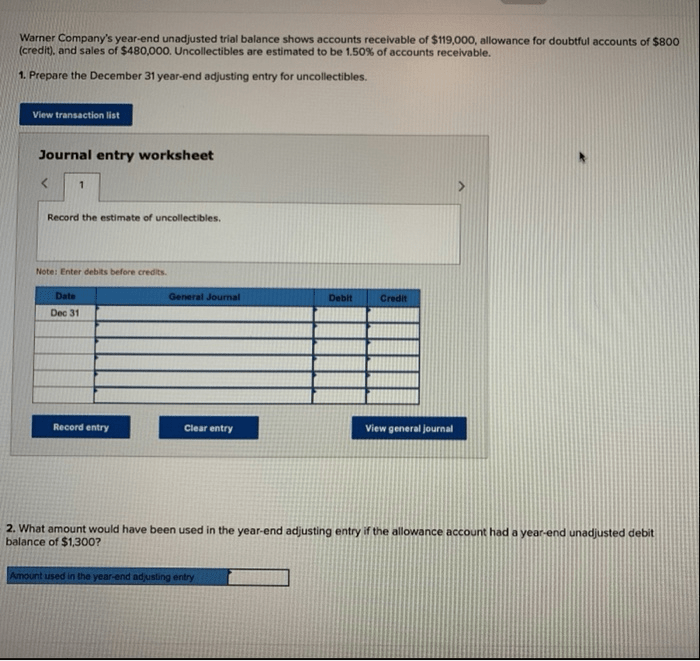

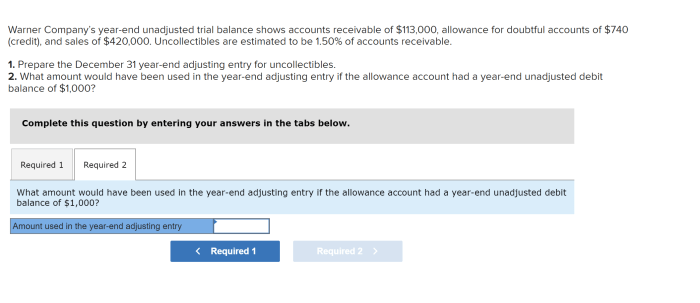

Overview of Warner Company’s Year-End Unadjusted Trial Balance: Warner Company’s Year End Unadjusted

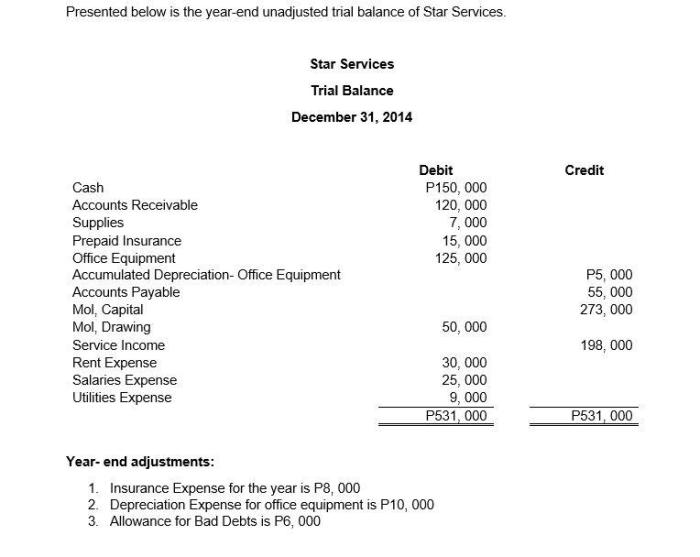

A year-end unadjusted trial balance is a financial statement that summarizes the balances of all ledger accounts at the end of an accounting period, before any adjusting entries have been made. It is an important tool for accountants as it provides a snapshot of the company’s financial position and helps to identify any errors or inconsistencies in the accounting records.

The year-end unadjusted trial balance typically includes the following components:

- A list of all asset accounts, with their corresponding balances

- A list of all liability accounts, with their corresponding balances

- A list of all equity accounts, with their corresponding balances

- A list of all revenue accounts, with their corresponding balances

- A list of all expense accounts, with their corresponding balances

Assets and Liabilities in the Unadjusted Trial Balance, Warner company’s year end unadjusted

The assets and liabilities sections of the year-end unadjusted trial balance provide a summary of the company’s financial position at a specific point in time. Assets are resources that the company owns or controls, while liabilities are debts that the company owes to others.

Assets are typically classified into the following categories:

- Current assets: These are assets that can be easily converted into cash within one year, such as cash, accounts receivable, and inventory.

- Non-current assets: These are assets that cannot be easily converted into cash within one year, such as land, buildings, and equipment.

Liabilities are typically classified into the following categories:

- Current liabilities: These are debts that are due within one year, such as accounts payable, notes payable, and accrued expenses.

- Non-current liabilities: These are debts that are not due within one year, such as long-term loans and bonds payable.

Revenues and Expenses in the Unadjusted Trial Balance

The revenues and expenses sections of the year-end unadjusted trial balance provide a summary of the company’s financial performance over a specific period of time. Revenues are the income that the company has earned from its operations, while expenses are the costs that the company has incurred in order to generate those revenues.

Revenues are typically classified into the following categories:

- Operating revenues: These are revenues that are generated from the company’s core business operations.

- Non-operating revenues: These are revenues that are generated from sources other than the company’s core business operations, such as interest income and dividend income.

Expenses are typically classified into the following categories:

- Operating expenses: These are expenses that are incurred in order to generate the company’s operating revenues.

- Non-operating expenses: These are expenses that are incurred for purposes other than the company’s core business operations, such as interest expense and loss on sale of investments.

Query Resolution

What is the purpose of a year-end unadjusted trial balance?

The year-end unadjusted trial balance provides a summary of the balances in all general ledger accounts before adjusting entries are made. It helps ensure that the total debits equal the total credits and serves as a starting point for the adjusting process.

What are the key components of a year-end unadjusted trial balance?

The key components include assets, liabilities, revenues, and expenses. Assets represent what the company owns, while liabilities represent what the company owes. Revenues and expenses reflect the company’s income and expenses over a specific period.

How is the year-end unadjusted trial balance used in the accounting process?

The year-end unadjusted trial balance is used to prepare adjusting entries, which are necessary to update the balances in the general ledger accounts and ensure that the financial statements are accurate. The adjusted trial balance is then used to prepare the financial statements, including the balance sheet and income statement.