Macroeconomics topic 2.4 price indices and inflation – Macroeconomics Topic 2.4: Price Indices and Inflation explores the fundamental concepts of measuring price changes and their profound impact on economies. Price indices, such as the Consumer Price Index (CPI) and Producer Price Index (PPI), serve as crucial tools for tracking inflation, a persistent economic phenomenon that can significantly influence individual and national well-being.

This topic delves into the causes and consequences of inflation, examining its various forms, including demand-pull and cost-push inflation. It also analyzes the role of central banks and governments in controlling inflation through monetary and fiscal policy tools. Furthermore, it investigates the potential impact of inflation on economic growth, considering its effects on investment, consumption, and productivity.

Price Indices and Inflation

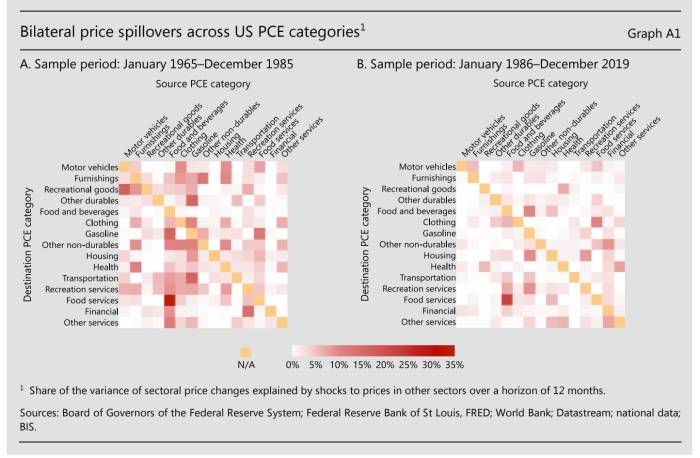

Price indices are statistical measures that track changes in the prices of goods and services over time. They are essential for measuring inflation, which is the rate at which prices rise.

There are different types of price indices, such as the Consumer Price Index (CPI) and the Producer Price Index (PPI). The CPI measures the prices of goods and services purchased by consumers, while the PPI measures the prices of goods and services sold by producers.

Price indices are used to track inflation and make economic decisions. For example, central banks use price indices to set interest rates, and governments use them to adjust tax brackets and social security benefits.

Inflation

Inflation is a sustained increase in the general price level of goods and services in an economy over a period of time.

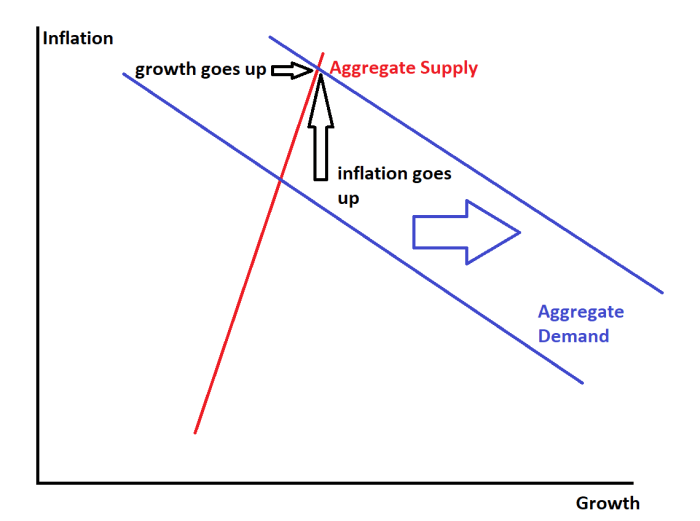

There are different types of inflation, such as demand-pull inflation and cost-push inflation. Demand-pull inflation occurs when there is an increase in aggregate demand, while cost-push inflation occurs when there is an increase in the costs of production.

Inflation can have a significant impact on the economy and individuals. For example, it can reduce the purchasing power of consumers and make it more difficult for businesses to plan for the future.

Central Bank Response to Inflation, Macroeconomics topic 2.4 price indices and inflation

Central banks are responsible for controlling inflation. They can use a variety of monetary policy tools to do this, such as raising interest rates and selling government bonds.

When inflation is too high, central banks will typically raise interest rates. This makes it more expensive for businesses to borrow money, which can lead to a decrease in investment and spending. As a result, inflation may slow down.

Government Response to Inflation

Governments can also use fiscal policy tools to control inflation. For example, they can increase taxes or decrease spending.

When inflation is too high, governments will typically increase taxes or decrease spending. This reduces the amount of money in the economy, which can lead to a decrease in inflation.

Impact of Inflation on Economic Growth

Inflation can have a significant impact on economic growth. For example, it can reduce investment, consumption, and productivity.

When inflation is too high, businesses may be less likely to invest in new projects. This can lead to a decrease in economic growth. Additionally, consumers may be less likely to spend money when inflation is high. This can also lead to a decrease in economic growth.

FAQ Guide: Macroeconomics Topic 2.4 Price Indices And Inflation

What is the Consumer Price Index (CPI)?

The Consumer Price Index (CPI) measures the average change in prices paid by urban consumers for a basket of goods and services, providing a key indicator of inflation.

What are the different types of inflation?

Inflation can be classified into demand-pull inflation, caused by an increase in aggregate demand, and cost-push inflation, resulting from an increase in production costs.

How do central banks control inflation?

Central banks use monetary policy tools, such as interest rate adjustments and quantitative easing, to influence the money supply and manage inflation.